Banking in Dubai might seem daunting, especially with the common perception that it caters exclusively to the affluent.

However, as someone who has navigated the financial landscape here, I can assure you that Islamic banks offer a refreshing blend of ethical finance and user-friendly digital services.

Opening my first account was a surprisingly swift process, even with my European passport in hand.

For those curious about which banks can truly simplify your financial journey while adhering to Sharia principles, you’re in the right place.

Join me as we explore some of the top Islamic banks in the UAE, busting myths and shedding light on practical insights that can enhance your banking experience.

Why To Choose an Islamic Bank in the UAE?

Choosing an Islamic bank in the UAE can be a prudent choice for European expats seeking ethical and transparent banking solutions. Unlike traditional banks that operate on interest-based systems, Islamic banks adhere to Sharia principles, which means your money is not only safe but also invested in socially responsible ventures. A common myth is that banking in the UAE is shrouded in secrecy and hidden fees; however, Islamic banks are known for their straightforward profit-sharing models, ensuring you have clarity on how your finances are managed. You’ll appreciate the absence of complex jargon and the emphasis on fair dealings, which aligns well with European banking standards. Ultimately, opting for an Islamic bank means your financial choices resonate with your values, fostering peace of mind as you navigate life in Dubai.

Dubai Islamic Bank (DIB)

Dubai Islamic Bank (DIB) stands as a leading example of how Islamic banking can harmoniously blend tradition and modernity in the UAE’s financial landscape. Unlike the common belief that all banks in Dubai cater solely to the affluent or operate in an impersonal manner, DIB offers an inviting atmosphere for everyone, including new expats looking to establish their financial footing. Their Sharia-compliant products not only ensure ethical banking but also cater to practical needs, like opening a first savings account.

Moreover, DIB is at the forefront of digital banking innovations, providing AI-driven financial tools and an intuitive online platform. As a long-term European resident, you’ll find their branches welcoming, with friendly staff ready to guide you through the banking process—making it a trusted choice for your everyday financial needs.

Abu Dhabi Islamic Bank (ADIB)

Abu Dhabi Islamic Bank (ADIB) stands out as a top choice for European expats navigating banking in Dubai, especially if you’re seeking a financial institution that aligns with your ethical values. Many newcomers believe that Islamic banks can be restrictive, but ADIB proves otherwise with its diverse, Sharia-compliant products like Smart Savings accounts and Green Home Loans, which are designed to meet modern financial needs. Their digital banking is notably efficient, allowing you to manage your finances without the inconvenience of lengthy queues.

With over 75 branches across the UAE, ADIB ensures accessibility, while their blockchain-enabled digital banking offers a glimpse into innovative financial solutions. Whether you’re looking for sustainable financing options or investment products compliant with ESG standards, ADIB caters to your needs with expert precision, making it an invaluable resource for expats in the city.

Emirates Islamic Bank

Emirates Islamic Bank stands out in Dubai’s financial landscape for its seamless integration of modern digital banking with Sharia-compliant principles, making it an excellent choice for European expats. Many newcomers worry that Islamic banks are mired in bureaucracy with endless paperwork; however, Emirates Islamic Bank dispels this myth by offering a user-friendly online account opening process and features like a voice-activated banking assistant. You can even benefit from their halal buy-now-pay-later service, which adds flexibility to your financial planning. The bank’s staff are notably helpful, often providing guidance with a warmth that makes banking feel less daunting. This approach not only simplifies ethical finance but also ensures that managing your finances in Dubai is both straightforward and accessible, allowing you to focus on settling into your new life without unnecessary stress.

Sharjah Islamic Bank (SIB)

Sharjah Islamic Bank (SIB) stands out as a reliable financial institution for European expats seeking Sharia-compliant banking solutions in the UAE. While many newcomers might overlook Sharjah as simply a quieter neighbour to Dubai, SIB’s offerings, such as the Al Khair Savings Account and Golden Account, demonstrate its robust financial capabilities. Some may believe that Islamic banking lacks modern conveniences; however, SIB challenges this myth with its innovative Islamic microloans, seamlessly blending tradition with contemporary banking needs.

SIB also emphasises community involvement by assisting you in managing your Zakat and actively supporting local initiatives. This commitment to social responsibility resonates well with those who want their finances to make a positive impact. Furthermore, language barriers are minimal, as the staff are notably friendly and eager to assist, ensuring you feel comfortable navigating your banking needs in this vibrant region.

Ajman Bank

Ajman Bank may not be as well-known as its glitzy Dubai counterparts, but it offers a refreshing take on Sharia-compliant banking, especially for European expats. Unlike larger institutions that often rely on convoluted jargon, Ajman Bank provides clear, straightforward Islamic banking solutions that align with your ethical values. You’ll find their branches welcoming, allowing for genuine interactions with knowledgeable staff rather than endless automated systems.

A standout feature is their 24/7 Islamic banking concierge, which can significantly ease the challenges of managing finances in a new country. Many newcomers assume that smaller banks lack robust services, but Ajman Bank proves otherwise with practical offerings like SME Murabaha financing and Halal auto lease options, ensuring ethical financial solutions without hidden surprises. In essence, this bank exemplifies how smaller institutions can deliver significant value to expats.

Al Hilal Digital (ADIB)

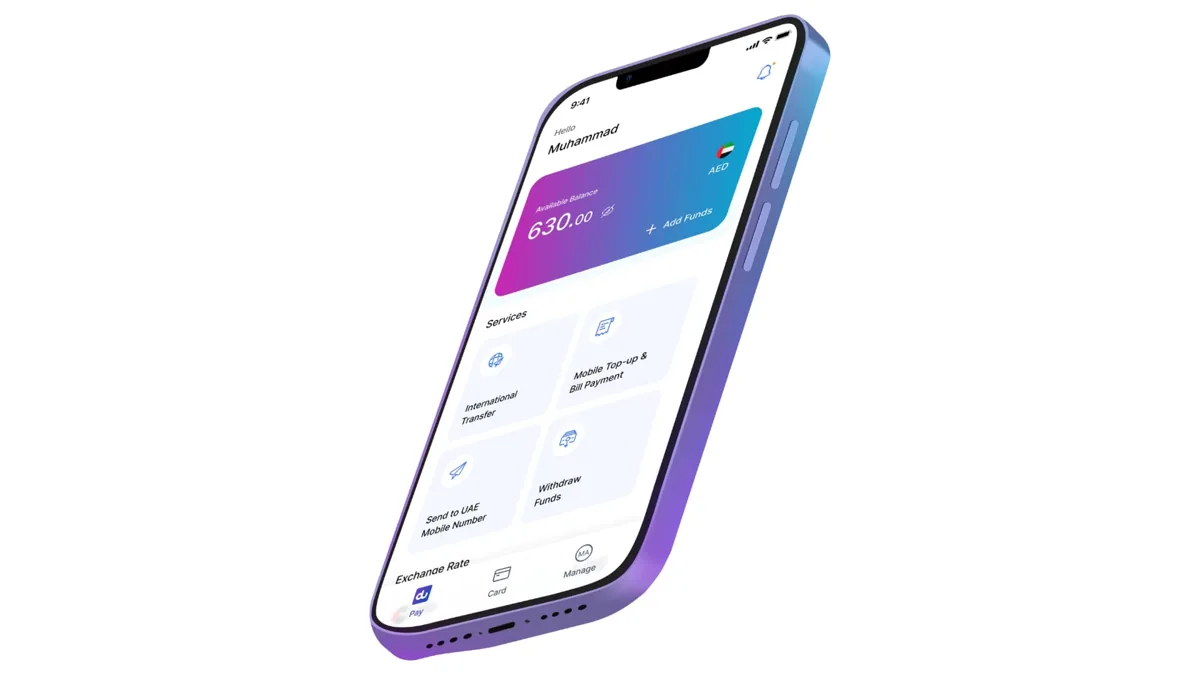

Al Hilal Digital emerges as a standout option for European expats in the UAE looking for a fully digital Islamic banking experience that prioritises convenience. Contrary to the common myth that Sharia-compliant banking is laden with bureaucratic hurdles and archaic processes, Al Hilal Digital simplifies everything with a user-friendly app. You can effortlessly open an account, make swift transfers, and even explore the metaverse—all from your smartphone.

This modern approach is particularly refreshing when compared to traditional banking methods in Dubai, which often involve long queues and complex formalities. With Al Hilal Digital, you can enjoy instant access to profit-sharing accounts and personal finance solutions tailored for a diverse clientele, making Islamic banking accessible for everyone, not just locals. Embracing this platform means stepping into the future of banking in Dubai without the usual complications.

RAK Islamic Bank

RAK Islamic Bank stands out for its efficiency, particularly appealing to European expats seeking swift and transparent banking solutions in Dubai. One notable feature is the bank’s ability to provide Sharia-compliant auto finance approval within just one hour—a claim you can trust, not just a sales pitch. Many expats mistakenly believe that all banks in Dubai are bogged down by tedious paperwork, but RAK Islamic Bank offers a surprisingly straightforward process that defies this common myth. Their AI-driven wealth management tools further simplify managing savings and investments, making them feel modern and user-friendly. Plus, with a strong commitment to ethical banking, you can rest assured that there are no hidden fees or confusing terms. If speed and clarity are what you desire, RAK Islamic Bank is a reliable choice that won’t let you down.

Mashreq Al Islami

When it comes to banking for expats in Dubai, Mashreq Al Islami offers a refreshing alternative to the often cumbersome processes found at other banks, such as RAK Islamic Bank. Many newcomers believe that opening a bank account here is as complex as navigating a maze; however, that’s a common misconception. In reality, Mashreq Al Islami excels in simplifying banking for non-residents, ensuring you won’t face unnecessary hurdles when setting up your account or accessing Sharia-compliant services.

Their account setup is straightforward, designed specifically for expats, meaning you won’t need to perform any financial gymnastics. Additionally, their home finance solutions are tailored for newcomers, helping you settle in with ease. With innovative offerings like NFT-based Islamic investment certificates, Mashreq Al Islami truly stands out for convenience and transparency, making your financial journey in Dubai much smoother.

CBD Islamic

If you’re considering banking in Dubai, you may have heard that it’s an exclusive realm for locals or affluent business leaders. However, as a European expat who has navigated this landscape, I can assure you that this is a misconception. CBD Islamic provides an accessible and welcoming banking experience for expatriates, offering Sharia-compliant accounts designed with ethical principles in mind.

One notable feature is their use of smart contract-based Islamic finance, which allows for transparent and secure transactions. Additionally, their corporate sukuk investment options present a compelling avenue for growing your savings with a peace of mind that aligns with your values.

Staff at CBD Islamic are not only friendly but also well-versed in assisting non-Arabic speakers, making the process even more approachable. This modern banking institution is an excellent choice for expats seeking both trust and transparency in their financial dealings.

Wio Islamic (New Digital Bank)

Digital banking in the UAE has evolved significantly, with Wio Islamic standing out as the first fully digital, Sharia-compliant bank. As a seasoned European expat in Dubai, you’ll appreciate the streamlined process Wio offers—no more waiting in queues or getting bogged down by paperwork. A common misconception about Islamic banking is that it can be overly complicated; however, Wio debunks this myth by providing an intuitive app that makes banking accessible and straightforward.

You can open and manage your account entirely online, freeing you from the need for branch visits. Wio also offers Sharia-compliant savings options and innovative peer-to-peer crowdfunding features, making it easier than ever to grow your wealth ethically. With instant notifications and smart budgeting tools, keeping track of your finances in dirhams has never been simpler. Embrace the future with Wio Islamic—banking that aligns with your values in the digital age.