When navigating the banking landscape in the UAE, it’s easy to assume it’s all about opulence and high-security vaults.

However, as someone who’s immersed in the local financial scene, I can assure you that the reality is refreshingly accessible.

Picture this: intuitive mobile apps, welcoming staff, and even the aroma of freshly brewed coffee at select branches.

For those from Europe, the banking experience here is surprisingly relatable, albeit with its own distinct UAE flair.

So, before you conjure up images of opening an account in the middle of the desert, let’s delve into what truly sets these banks apart and discover which could become your financial sanctuary in this vibrant city.

Emirates NBD

When it comes to banking in Dubai, Emirates NBD stands out as a top choice for European expats seeking reliable financial services. Contrary to the misconception that it’s exclusively for the wealthy or Emiratis, this bank is designed to accommodate a wide range of customers. For those looking to establish a savings account, Emirates NBD offers various options in AED and major foreign currencies, typically requiring a minimum balance of AED 3,000.

Their user-friendly digital platforms, such as Liv. and ENBD X, simplify money management, making budgeting, investing, or transferring funds seamless. As a long-term resident, you’ll find the account setup process straightforward, complemented by responsive customer service that helps you feel right at home. Don’t let myths deter you; Emirates NBD is genuinely inclusive and ready to cater to your banking needs.

Emirates Islamic Bank

Opening a bank account in Dubai as a European expat can seem daunting, especially with the common misconception that Islamic banking is overly complicated. In reality, Emirates Islamic Bank offers a modern and user-friendly experience, tailored for tech-savvy individuals like you. Their digital services make online banking a breeze, allowing you to manage your finances effortlessly.

You can choose from various account types, each with unique benefits. For instance, the Kunooz Millionaire account requires a minimum balance of AED 3,000 and gives you a chance to win monthly cash prizes. If you prefer something without a minimum balance, the e-Savings account offers competitive profit rates of up to 4.5% per annum, making it an appealing option.

Here’s a quick overview of your choices:

| Account Type | Minimum Balance | Key Benefit |

|---|---|---|

| Kunooz Millionaire | AED 3,000 | Win monthly cash prizes |

| e-Savings | None | Up to 4.5% p.a. profit |

| Emarati Family Savings | None | Family-friendly, higher profits |

| Investment Savings | AED 3,000 | International debit card |

With knowledgeable staff ready to assist newcomers, you can feel confident navigating the banking landscape in Dubai.

First Abu Dhabi Bank (FAB)

When considering banking options in Dubai, many European expats often wonder if Islamic banking can truly compete with traditional services. First Abu Dhabi Bank (FAB), the UAE’s largest bank, proves that it can, offering an impressively user-friendly experience. One of its standout features for expatriates is the iSave Account, which provides promotional rates of up to 4.50% p.a. without the hassle of minimum balances or withdrawal limits.

A common misconception is that navigating banking in Dubai requires extensive local knowledge; however, FAB’s digital tools allow you to manage your finances almost entirely online, making it feel just like banking back home in Europe. Whether you’re managing your salary or saving in euros, FAB’s straightforward approach ensures that banking is as effortless as it should be for a busy expat like you.

Abu Dhabi Commercial Bank (ADCB)

In the realm of banking in Dubai, Abu Dhabi Commercial Bank (ADCB) is a standout option for European expats seeking simplicity and efficiency. Unlike the common misconception that UAE banks are overwhelmingly complex, ADCB offers a seamless experience with features tailored for your needs, such as digital onboarding and English-speaking support. Opening a savings account requires just your Emirates ID and a straightforward online form, making it accessible for anyone residing in the city.

ADCB’s savings accounts boast competitive interest rates and low minimum balance requirements, which are particularly appealing to newcomers. The user-friendly mobile app allows you to manage your finances effortlessly, from transferring euros to handling dirhams. Having navigated the banking landscape in Dubai for years, I can confidently say that ADCB simplifies the process for expats, turning it into a more manageable experience.

Mashreq Bank

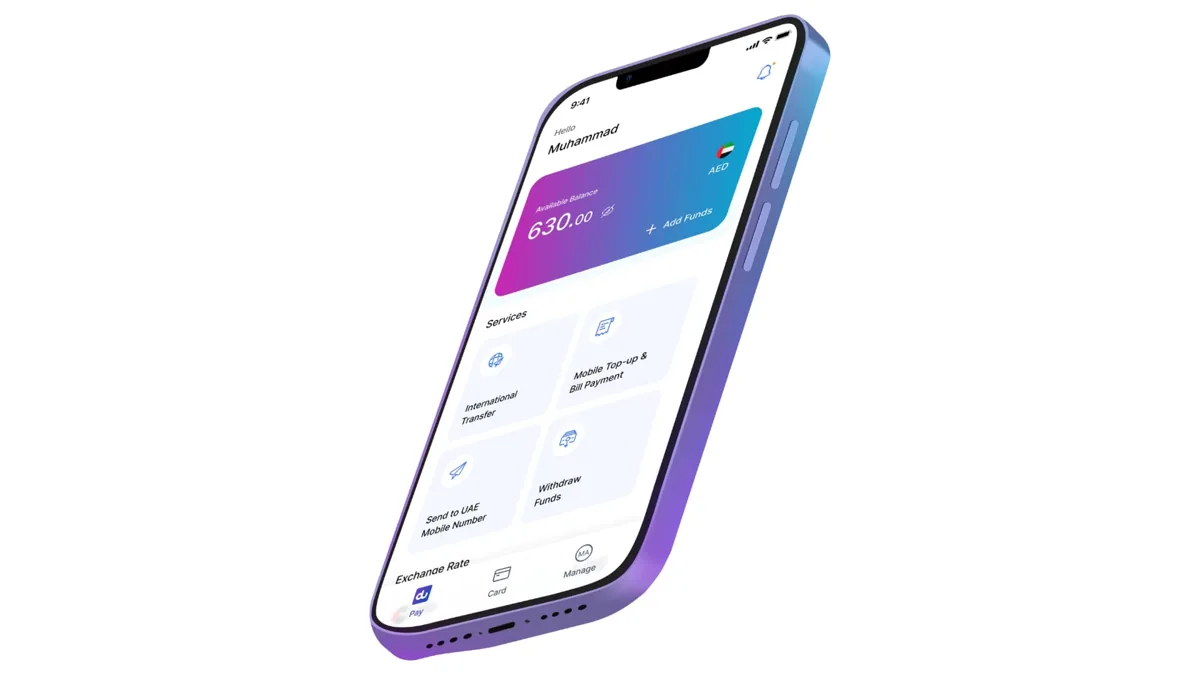

When considering banking options in Dubai, Mashreq Bank stands out with its innovative digital banking services tailored for expats. The user-friendly app allows you to open an account instantly, a feature that many newcomers appreciate, given the common myth that banking in Dubai is a lengthy and complicated process. In reality, you can effortlessly track your spending, set savings goals, and even pay bills back home—all within a few taps. This seamless integration into your financial life not only simplifies your banking experience but also enhances your financial management. Furthermore, Mashreq’s robust platform supports various currencies, making it ideal for European residents navigating different financial landscapes. Overall, it’s a refreshing approach to banking that aligns well with the fast-paced lifestyle in Dubai while ensuring you stay connected to your roots.

Dubai Islamic Bank (DIB)

One of the most notable aspects of living in Dubai is the prominence of Dubai Islamic Bank (DIB), a leading institution that caters to both locals and expats. Many European newcomers may mistakenly believe that Islamic banking is overly complicated or exclusively for Emiratis, but DIB dispels this myth with its user-friendly approach and efficient services. Operating on Shariah principles, DIB replaces traditional interest with profit-sharing, which is an innovative twist that can be quite appealing.

Their advanced digital tools, including user-friendly mobile apps for effortless transfers, make banking straightforward. Moreover, DIB’s customer service is exceptionally accommodating, often featuring staff fluent in multiple languages, ensuring smooth communication. Many expats praise the seamless account setup process, highlighting DIB’s commitment to making banking a stress-free experience for everyone. If you’re looking for a trustworthy banking option in Dubai, DIB is certainly worth considering.

National Bank of Fujairah (NBF)

The National Bank of Fujairah (NBF) is a hidden gem for European expats seeking a more personalised banking experience in the UAE. While it may not boast the extensive brand recognition of larger banks in Dubai and Abu Dhabi, NBF prioritises genuine service over flashy marketing. Many expats often believe that only the largest banks can offer robust services; however, NBF proves that smaller institutions can also provide excellent personal and SME banking. Their focus on personal service means you won’t feel like just another account number; instead, you’ll benefit from dedicated relationships with banking professionals.

Additionally, NBF’s digital banking app is both secure and user-friendly, allowing you to manage your finances effortlessly. The simplicity of their account structures ensures no hidden fees, making budgeting straightforward. When it comes to banking, you’ll find that NBF listens to your needs and adapts accordingly.

Standard Chartered UAE

If you’re seeking a bank that harmoniously combines global expertise with local insight, Standard Chartered UAE deserves your attention. Unlike the stereotype that all banks in Dubai focus solely on luxury and extravagance, this institution offers practical solutions tailored for expats. Their savings and current accounts come equipped with user-friendly digital banking features, multi-currency options, and competitive interest rates, making managing your finances straightforward whether you’re relaxing at Jumeirah Beach or navigating JLT’s busy roads.

One common misconception is that banking in Dubai is prohibitively complex; however, Standard Chartered demonstrates that it can be accessible and efficient. Their staff are well-versed in the unique needs of expats, facilitating seamless international transfers and providing support for everyday banking essentials, thus making your financial journey in Dubai a breeze.

RAKBANK

Envision this: as a European expat in Dubai, you’re enjoying a cappuccino in Ras Al Khaimah while realising that banking doesn’t have to be complicated. Contrary to popular belief, navigating financial services here can be refreshingly straightforward, especially with RAKBANK. Their mobile app is user-friendly, allowing you to manage your finances seamlessly from your sofa or even poolside.

One common misconception is that banking in the UAE involves endless paperwork and bureaucratic red tape. However, with RAKBANK, you can open an account instantly without the hassle of “lost in translation” moments. You’ll also appreciate the arrival of your debit card at your doorstep within days and the genuinely friendly customer service that answers your calls.

Banking in Dubai is evolving, and RAKBANK exemplifies this shift, making it a practical choice for expats.

Abu Dhabi Islamic Bank (ADIB)

When it comes to banking in Dubai, Abu Dhabi Islamic Bank (ADIB) stands out as a modern choice that seamlessly integrates Islamic principles with user-friendly digital services. Many expats may hold the misconception that “Shariah-compliant” banking involves cumbersome procedures and prohibitive rules. However, ADIB proves otherwise with its streamlined account opening, intuitive online banking, and contactless cards, all designed to cater to the busy lives of modern residents.

As a European expat, you’ll find their English-speaking staff incredibly helpful, ensuring you navigate your banking needs without a hitch. The straightforward mobile app offers transparency, meaning you won’t encounter hidden fees, making savings accounts both accessible and practical. With ADIB, your investments align with ethical values, avoiding industries you might not support, and enhancing the overall sense of financial well-being in Dubai.